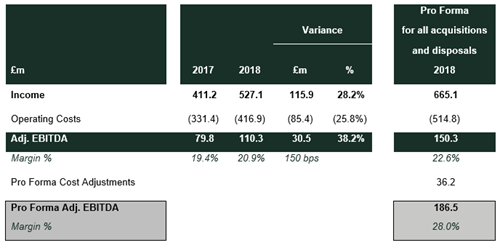

Strong growth in reported income and EBITDA

- Taking into account all acquisitions and disposals, Ardonagh generated Pro Forma income of £665m and Pro Forma adjusted EBITDA of £187m*

- Operating Cash Conversion of 80%, free cash flow breakeven in second half of year and available liquidity of £216m

- Delivery of £18m cost savings

- Margin improvement of +150 bps versus prior year

- Six consecutive quarters of organic growth

The Ardonagh Group (‘Ardonagh’ or ‘the Group’), the UK’s leading, diversified independent insurance broker, today announces its full year results covering the twelve months to 31 December 2018.

Chairman John Tiner commented: “Today we report on the Group’s first full year of operation; a pivotal year for the business. We have reshaped our portfolio, through the acquisition of Swinton, the leading personal lines brand, and the disposal of both our claims and commercial MGA businesses. We also largely completed the turnaround of the Towergate business that the current shareholders, board and management team inherited in 2015.

Channel Financial Highlights

CHANNEL HIGHLIGHTS

Ardonagh Broking:

- Income growth of 26% to £295m and adj. EBITDA margin improvement to 27.8%

- Much of the heavy lifting to integrate Insurance Broking is complete, with 90%+ users now on new Acturis system, positioning 2019 for further growth

- Improvement in staff retention of key producers in Advisory

- Autonet & Carole Nash delivered a strong performance in 2018, with good organic growth and an increasing number of policies under management while integrating Carole Nash and turning around the income trajectory of this business by boosting its digital distribution platform

- Paymentshield has continued to grow total policies under management +4.8% and new business policy volume +15%. Income adversely impacted by IFRS 15 accounting change and one-time reduction to profit share due to weather related claims

Ardonagh Specialty:

- Reported income has doubled, driven by full 12 months of Price Forbes as part of Ardonagh, organic growth of 10.8% and success in Aviation, Mining and North American Binders

- Price Forbes and Bishopsgate working together on combined initiatives across multiple classes as well as implementing a regional production strategy with particular success in Latin America

- Former Lloyd’s CEO Dr Richard Ward joined in September 2018 to head up the segment and hire further industry leading business producer and management talent to drive further growth

Ardonagh MGA:

- Claims disposal completed 16 October 2018

- Remediation of Commercial MGA to improve the long term sustainability of the business led to disposal for £31.5m which completed 1 January 2019

- Geo Specialty proposition focused on specialist and niche areas have reinvigorated focus and oversight

- Strategic decision in Schemes & Programmes to step back from online SME distribution via third parties in favour of SME telephone advice

Chief Executive Officer David Ross said:

“We have a number of reasons to celebrate Ardonagh’s progress in 2018. The hard work behind the scenes to improve our systems and processes is paying off and has paved the way to cross-group collaboration and organic growth.

Whether that’s Carole Nash benefitting from Autonet’s digital platforms or Price Forbes and Geo Specialty teaming up to underwrite and place terrorism cover for a client of an advisory branch, our community of entrepreneurial thinkers with deep customer and technical understanding is creating something exciting.

Our position in the wider market is not to be underestimated. In a year of significant industry consolidation, we are proud to offer a credible alternative of scale to insurers and clients.

That alternative is getting stronger by the day, as our systems integrations give us a deeper data-driven understanding of the risks our clients face.

Aside from the headline profit and growth metrics, one figure I’m particularly proud of is the number of people who have chosen to continue their careers with the Group. In our largest segments, voluntary staff turnover has fallen to less than half of what it was at the beginning of 2015. This is no surprise given the vast progress made in engaging with our people. By recognising their input through channels such as our annual Spotlight Awards, where the very best teams and individuals are celebrated and rewarded, through to improved maternity pay and a commitment to increased investment in female leaders, the Ardonagh Group of companies are increasingly employers of choice.

* Pro forma for all material acquisitions and disposals including; acquisition of Swinton, disposal of Commercial MGA, disposal of Claims business, acquisition of Nevada 3 Businesses MHG, HIG & PfP (completed 31 Jan 2019), and for annualisation of cost savings from completed actions and actions expected to be completed during 2019

- We define “Adjusted EBITDA” or “Adj. EBITDA” as the earnings after adding back finance costs, tax, depreciation, amortisation, impairment of goodwill, foreign exchange movements, dividends received, discontinued operations, restructuring costs, transformational hires, business transformation costs, legacy costs, regulatory costs, acquisition and financing costs, profit/loss on disposal of businesses, investments or assets, share of operating profit/loss from associate, reduction/increase in the value of contingent consideration, as applicable. Adjusted EBITDA is stated before exceptional costs and one-off items as determined by management.

- We define “Free Cash Flow” as cash flow after proceeds from disposals, investments and interest, but before ETV costs, M&A and other financing cash flows.

- We define “Organic” as excluding the impact of acquired or exited businesses and other non-recurring items and is set out at constant FX.

- We define “Pro Forma Adjusted EBITDA” or “Pro Forma Adj. EBITDA” as the Adjusted EBITDA of the business as adjusted for certain cost saving initiatives and cost synergies.

- We define “Free Cash Flow” cash flow after proceeds from disposals, investments and interest, but before ETV costs, M&A and other financing cash flows

Latest announcements

Ardonagh Advisory builds presence in northwest England with acquisition of SIB Insurance

Ardonagh Advisory has acquired Southport Insurance Brokers Limited (SIB Insurance), an independent commercial broker, further strengthening Ardonagh’s presence in the northwest of England.

Ardonagh Advisory completes acquisition of Westfield Insurance

Further to its announcement in December that it had exchanged contracts, Ardonagh Advisory has completed its acquisition of Westfield Brokers Ltd.