24 March 2021

“Strength and resilience from scale and diversification of our platforms”

The Ardonagh Group (‘Ardonagh’ or ‘the Group’) today announces its full year results covering the twelve months to 31 December 2020.

Group Highlights

- Strong performance throughout the year thanks to continued delivery on our three-pillar strategy combining organic growth initiatives, accretive acquisitions and operational excellence

- Underlying organic income growth of 2.8%, excluding limited impact from Covid-19

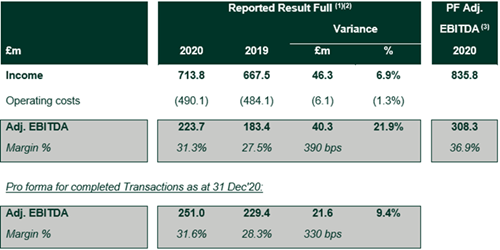

- Pro Forma Adj. EBITDA of £308m including completed or contractually committed acquisitions to date, alongside annualisation of cost savings and synergies

- Operating cash conversion of 97%

- Refinancing completed in July with long term debt facilities in place until 2026 and access to the funding facilities to support future growth

- Successfully navigated the challenges presented by the pandemic for our clients and our people

Chairman John Tiner commented: “Ardonagh’s focus on clients and the resilience and determination of our people, together with excellent financial results, cash flow generation, strong underlying organic and inorganic growth and a refinanced balance sheet, including a substantial M&A facility, have once again validated the Group’s business model and strategy.

“From the start of the pandemic just over 12 months ago it was clear that clients from across our uniquely diversified business, from households to care homes, from small businesses to major international companies, were facing unprecedented and severe vulnerabilities. As their trusted advisers, we planned our own response to the operational challenges presented by the national lockdown in a way which enabled our colleagues to seamlessly continue providing the support and guidance our clients have come to expect from us.

“Having overcome the challenges presented by Covid-19, and with a highly flexible, long term capital structure in place, we are firmly focused on capitalising on the significant opportunities which lie ahead both domestically and across international markets. In the UK we made a number of highly accretive acquisitions which have broadened our capabilities in products and enhanced our distribution network. In the last 12 months we also made significant progress in our international strategy with acquisitions in Ireland and Australia, partnering with businesses and leaders whose ambitions match ours. We expect to capitalise on this momentum and see this international expansion continue at pace.”

CEO David Ross commented: “Over recent years, Ardonagh has grown with purpose to become the most diverse insurance broker, with natural protection against volatility from any one product, sector of the economy or currency. Never has our strategy been more tested and never before have the strengths of this approach been so evident.

“The growth we report today is testament to our culture of resilience and resolve. I want to thank each and every one of my 7,000 colleagues who supported each other and their customers through challenging times. It is somewhat ironic that an event that scattered the workforce to kitchens and bedrooms ended up bringing us closer together as a team, validated with scores rising in our recent engagement survey on each and every measure.

“We look with optimism to the rollout of a vaccine and the lifting of lockdown restrictions, knowing we will not return to the way things were but drawing on the experience to become an even stronger global presence.”

1) Reported result which includes acquisitions and disposals from the completion date.

2) “Adjusted EBITDA” or “Adj. EBITDA” defined as EBITDA after adding back discontinued operations, restructuring costs, Transformational Hires, Business Transformation Costs, Legacy Costs and Other Costs, regulatory costs, acquisition and financing costs, profit/loss on disposal of businesses or investments, share of operating profit/loss from associate, reduction/increase in the value of contingent consideration, as applicable. Adjusted EBITDA is stated before exceptional costs and one-off items as determined by management.

3) Pro forma for all acquisitions completed and contractually committed to 24 Mar’21 and including annualisation of cost savings and synergies from completed actions and actions expected to be completed during 2021.

Notes to Editors

THE ARDONAGH GROUP

The Ardonagh Group is the UK’s largest independent insurance broker powered by a network of over 100 locations across the UK and Ireland and a workforce of over 7,000 people. Formed in 2017, Ardonagh today brings together best-in-class brands including Autonet, Arachas, Bishopsgate, Broker Network, Carole Nash, Compass Networks, Ethos Broking, Geo Underwriting, Price Forbes, Swinton, Towergate and URIS.