The Ardonagh Group (‘Ardonagh’ or ‘Group’) today announces its results for the six months ended 30 June 2022.

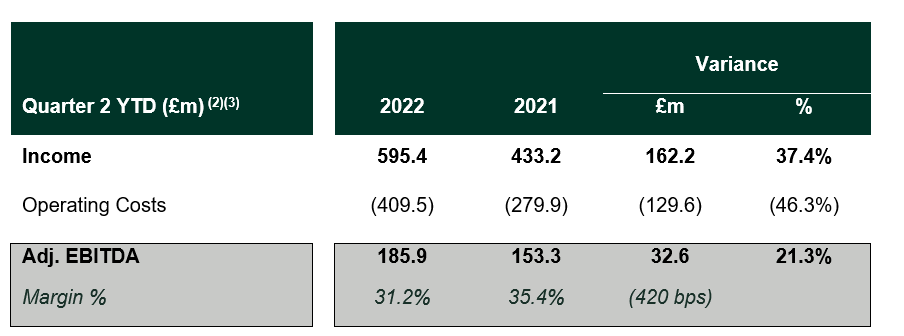

Income rose by 37% to £595 million ($791 million) and Adjusted EBITDA by 21% to £186 million ($247 million).

Group organic growth was 7% for the last six months, with Specialty recording organic growth of 12% and Ardonagh International exceeding 10%.

Ardonagh Specialty grew by 102% following the acquisition of Besso Insurance, Ed Broking and Piiq Risk Partners and ongoing producer hires, while Ardonagh International grew by 69% fuelled by expansion in Australia, Ireland, Germany and the USA.

Ardonagh Specialty and International together contributed 44% of group income in the first six months of 2022, compared with 31% the previous year.

Unlevered free cash flow(1) was £216 million ($286 million) for the 12 months to 30 June 2022. The Group had £683.3 million ($907.4 million) available liquidity as of 30 June 2022.

Group CEO David Ross commented: “These results reflect the strength of our business model, with presence across multiple product lines, industries and geographies providing natural resilience and opportunity.

“In particular our organic growth shows what happens when independent businesses are connected through a shared vision of client focus and innovation, and with the support of long-term backers.

“As a leading international independent broker we’re committed to build on what we have learned from our growth so far and to make the most of the diverse perspectives that have and will join us. To that end the launch of Ardonagh Academy in partnership with the Centre for Creative Leadership was a highlight of the quarter.”

In December 2021, Ardonagh was valued at $7.5 billion as part of a significant new equity investment led by existing long-term shareholders Madison Dearborn Partners and HPS Investment Partners. The transaction closed on 31 May 2022 and resulted in a change to the holding company of the Group. The results are presented on a comparable basis for the full six-month period.

1) Unlevered Free Cash Flow defined as cash flow after investments and tax, but before interest, ETV costs, M&A and other financing cash flows

2) Includes acquisitions and disposals from the completion date.

3) “Adjusted EBITDA” or “Adj. EBITDA" defined as EBITDA after adding back discontinued operations, restructuring costs, Transformational Hires, Business Transformation Costs, Legacy Costs and Other Costs, regulatory costs, acquisition and financing costs, profit/loss on disposal of businesses or investments, share of operating profit/loss from associate, reduction/increase in the value of contingent consideration, as applicable. Adjusted EBITDA is stated before exceptional costs and one-off items as determined by management.

Latest announcements

Ardonagh Advisory acquires Shropshire-based Rollinson Smith Insurance Brokers

Ardonagh Advisory has acquired Rollinson Smith Insurance Brokers (“RSIB”), a leading community broker servicing the Shropshire, Staffordshire, West Midlands and North Wales regions with significant reach in London and other areas of the country.

Atlanta Group and Markerstudy merger completed

Further to its announcement in September 2023, The Ardonagh Group confirms it has completed the merger between its personal lines broking business Atlanta Group and Markerstudy.