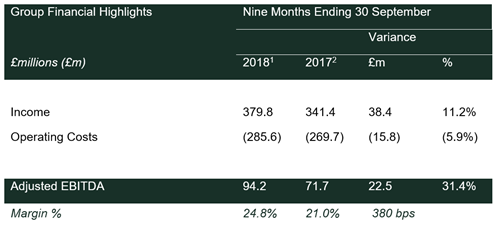

Continued top and bottom-line growth with Income up 11.2% and Adjusted EBITDA up 31.4% YTD

The Ardonagh Group (“Ardonagh” or the “Group”) today announces its financial results for the period ended 30 September 2018.

Group income1 increased by 11.2% to £379.8m in the first nine months of the year, driven by underlying organic growth of 2.4%, continued investment in new hires and acquisitions completed in 2017.

Successful integration across the Group with a focus on delivery of cost reduction plans boosted the YTD margin by 3.8 percentage points to 24.8%. Adjusted EBITDA1 grew by 31.4% to £94.2m.

Ardonagh Group CEO David Ross said: “The latest results are another solid demonstration of new business, customer retention and investment continuing to drive profitable growth.

Following the sale of our Commercial MGA and the Claims business, and strategic purchases in broking and distribution, we are focused on driving value from our core markets.

Having spent the last three years talking about investments in people and infrastructure, it’s great to see Ardonagh enjoying the benefits.”

GROUP OPERATIONAL HIGHLIGHTS

- Adj. EBITDA up 40% for the quarter vs. prior year with continued margin expansion from 16.9% to 21.1%

- Strong growth in both retention and new business across most segments alongside delivery of cost reduction plans

- Continued investment in industry leading international income producers and management bringing new skills and expertise to drive income growth

- Agreement to acquire Swinton Holdings Limited from Covéa Group for a consideration of approximately £165 million, subject to FCA approval

- Net Secured Leverage 5.2x pro forma for acquisitions, disposals and the new $235m senior secured mirror notes

POST QUARTER EVENTS

- Sale of Schemes and Programmes’ Claims business to Davies Group for up to £36m announced 16 October

- Agreement to acquire Minton House Group Limited (“MHG”), Health and Protection Solutions Limited (“HIG”) and Professional Fee Protection Limited (“PfP”) from HPS Investment Partners and Madison Dearborn Partners announced 29 October, subject to FCA approval

- Agreement to sell Commercial MGA to Arch UK Holdings Limited for up to £31m announced 1 November

- $235m bond raise primarily to finance Swinton acquisition completed 20 November

1Pro forma for all M&A completed as at 30 September 2018, plus the Claims and Commercial MGA Disposals (signed in Q4 2018)

2 Pro forma for the pre-June’17 acquisitions of Autonet, Chase Templeton, Direct Group and Price Forbes only, plus the Claims and Commercial MGA Disposals

Notes to Editors

THE ARDONAGH GROUP

The Ardonagh Group is the UK’s largest independent insurance broker with global reach. We are a network of over 100 office locations and a workforce of almost 6,000 people. The Ardonagh Group was created in June 2017, bringing together Autonet, Chase Templeton, Direct Group, Price Forbes and Towergate, with the additional acquisitions of Healthy Pets in August 2017, and Carole Nash and Mastercover announced in December 2017. Our understanding of the communities we serve, together with our scale and breadth, allows us to work with our insurer partners to deliver solutions that meet our customer needs.

Media Queries Internal & External Contact

-

Email: communications@ardonagh.com

Investor Relations Contact

Karen Noakes - Corporate Finance and Investor Relations Director

Email: karen.noakes@ardonagh.com

Latest announcements

Ardonagh Advisory builds presence in northwest England with acquisition of SIB Insurance

Ardonagh Advisory has acquired Southport Insurance Brokers Limited (SIB Insurance), an independent commercial broker, further strengthening Ardonagh’s presence in the northwest of England.

Ardonagh Advisory completes acquisition of Westfield Insurance

Further to its announcement in December that it had exchanged contracts, Ardonagh Advisory has completed its acquisition of Westfield Brokers Ltd.