19 May 2021

The Ardonagh Group (‘Ardonagh’ or ‘the Group’) today announces its results covering the three months to 31 March 2021.

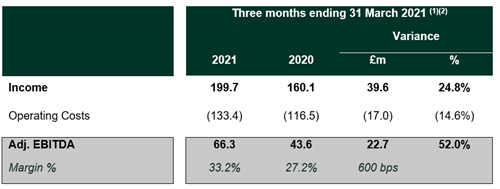

Group income increased by 24.8% to £199.7 million for the quarter and Adjusted EBITDA by 52% to £66.3 million due to a combination of acquisitions and continued organic growth, with particularly strong organic growth in Specialty driven by a successful producer hiring programme.

The Group completed several acquisitions during the quarter including telematics specialist Marmalade, PI broker Hera Indemnity, Australia’s largest independently owned intermediary network, Resilium and US healthcare and benefits underwriter AccuRisk Solutions.

Margins have been improved by growth initiatives including carrier facilities, closer collaboration across the Group and platform integration.

Operating cash conversion was maintained at 97% and free cash flow was strongly positive for the 12 months to 31 March 2021. Available liquidity was maintained at over £290 million.

Group CEO David Ross said: “Ardonagh continues to deliver strong results across all our operating platforms. We have created a compelling proposition for individuals and companies that value independence, agility and scale. Every addition to the group has broadened our client proposition and made us stronger as a Group and each in turn is stronger as part of a larger collective.

“We will maintain our disciplined approach to acquisitions whilst continuing to integrate within the platforms and collaborate to deliver the best solutions for our clients.”

1) Reported result which includes acquisitions and disposals from the completion date.

2) “Adjusted EBITDA” or “Adj. EBITDA" defined as EBITDA after adding back discontinued operations, restructuring costs, Transformational Hires, Business Transformation Costs, Legacy Costs and Other Costs, regulatory costs, acquisition and financing costs, profit/loss on disposal of businesses or investments, share of operating profit/loss from associate, reduction/increase in the value of contingent consideration, as applicable. Adjusted EBITDA is stated before exceptional costs and one-off items as determined by management.

Notes to Editors

THE ARDONAGH GROUP

The Ardonagh Group is the UK’s largest independent insurance broker powered by a network of over 100 locations across the UK and Ireland and a workforce of over 7,000 people. Formed in 2017, Ardonagh today brings together best-in-class brands including Autonet, Arachas, Bishopsgate, Broker Network, Carole Nash, Compass Networks, Ethos Broking, Geo Underwriting, Price Forbes, Swinton, Towergate and URIS.

Latest announcements

Ardonagh Advisory builds presence in northwest England with acquisition of SIB Insurance

Ardonagh Advisory has acquired Southport Insurance Brokers Limited (SIB Insurance), an independent commercial broker, further strengthening Ardonagh’s presence in the northwest of England.

Ardonagh Advisory completes acquisition of Westfield Insurance

Further to its announcement in December that it had exchanged contracts, Ardonagh Advisory has completed its acquisition of Westfield Brokers Ltd.