The Ardonagh Group 2019 financial highlights

25 March 2020

The Ardonagh Group 2019 financial highlights

The Ardonagh Group (‘Ardonagh’ or ‘the Group’), the UK’s leading, diversified independent insurance broker, today announces its financial highlights for the twelve months to 31 December 2019(1).

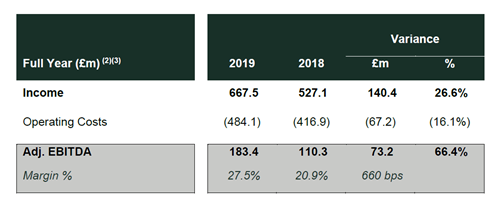

Income rose by 26.6% to £667.5m whilst operational integration and a focus on growth initiatives delivered a 66.4% increase in Adjusted EBITDA to £183.4m.

Chairman John Tiner commented: “Ardonagh’s resolute commitment to achieving operational efficiency, growing new areas of the business and effectively integrating accretive acquisitions shines through in the substantial profitable growth reported in 2019.

“As the investment in transformational spend drew to a close as planned, underlying profitability has risen sharply with reported EBITDA up by 288% to £115.3 million and adjusted EBITDA rising by 66% to £183.4 million. The Group finished the year with a liquidity position of £181.7m.

“Our highly diversified product portfolio, scale, efficiency and flexible operating platforms limits our reliance on any single part of the UK economy, leaving us in a in a strong position from which to weather the impact of the Covid-19 pandemic.

“Insurance broking is an essential sector and the need for trusted risk advice is more important than ever. In these uncertain times, we remain very confident in the strength and resilience of our business.”

Platform Financial Highlights

Platform Highlights

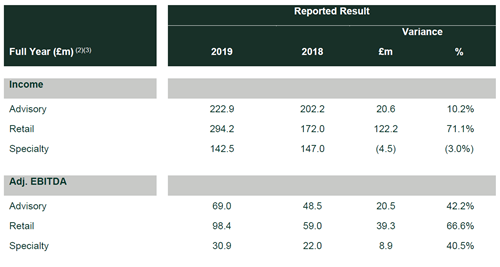

Our Advisory platform completed the roll out of Acturis in 2019. All in scope branches have now completed a full annual renewal cycle on a single system. We launched a new corporate practice with has won the largest UK clients to date.

In Health, we integrated Chase Templeton and The Health Insurance Group with Towergate Health and Protection into what is now a six-site business with 25,000 SME clients, making it the largest broker in the field.

We also made significant progress in our placement strategy to reduce the number of carriers and deliver better outcomes for clients.

In Retail we finished the year with the successful integration of Swinton ahead of plan with significant cost reductions achieved during the year. The business has been transformed by a move onto Atlanta’s digital platform, a simplified suite of products and the addition of new panel members. Paymentshield achieved a number one market share of new business with every major IFA network whilst Schemes & Programmes withdrew from unprofitable business to focus on higher-margin niche markets.

Specialty continued to recruit a number of leaders in niche and specialist areas whilst focusing on modernising its operating model, reducing costs, standardising processes, digitising its front-end portfolio offerings.

Chief Executive Officer David Ross said:

“Ardonagh has become an established force in the market. The last year has seen a continued focus on execution and delivery of our strategy, one which has been fully affirmed by the Group’s major shareholders decision to increase their holdings via a £92 million investment in May.

2019 was been a significant point in our history as we shifted from building a core platform to capitalising on the opportunities its creation has enabled.

2019 already seems like a long time ago. As we look ahead to a period of domestic and global uncertainty, all the work that has taken place since the formation of the Group to upgrade our systems, diversify our business and connect our people and clients leaves us well positioned to adapt and remain resilient. We will continue to serve our clients however we best can.”

- The financial highlights are drawn from unaudited financial statements following the FCA and FRC’s request for a moratorium on the publication of preliminary financial statements for at least two weeks as listed companies and the audit profession are facing unprecedented practical challenges during the Coronavirus crisis. The Group will reschedule the release of its audited financial statements when further guidance from the FCA and FRC has clarified the position.

- Reported result which includes acquisitions and disposals from the completion date

- “Adjusted EBITDA” or “ EBITDA" defined as EBITDA after adding back discontinued operations, restructuring costs, Transformational Hires, Business Transformation Costs, Legacy Costs and Other Costs, regulatory costs, acquisition and financing costs, profit/loss on disposal of businesses or investments, share of operating profit/loss from associate, reduction/increase in the value of contingent consideration, as applicable. Adjusted EBITDA is stated before exceptional costs and one-off items as determined by management.

Notes to Editors

THE ARDONAGH GROUP

The Ardonagh Group is the UK’s largest independent insurance broker with global reach. We are a network of over 100 office locations and a workforce of nearly 7,000 people. Formed in 2017 and following a series of acquisitions in 2018, Ardonagh today brings together best-in-class brands including Autonet, Bishopsgate, Carole Nash, Geo Underwriting, Price Forbes, Swinton, Towergate and URIS. Our understanding of the communities we serve, together with our scale and breadth, allows us to work with our insurer partners to deliver solutions that meet our customer needs.

Latest announcements

Ardonagh Advisory builds presence in northwest England with acquisition of SIB Insurance

Ardonagh Advisory has acquired Southport Insurance Brokers Limited (SIB Insurance), an independent commercial broker, further strengthening Ardonagh’s presence in the northwest of England.

Ardonagh Advisory completes acquisition of Westfield Insurance

Further to its announcement in December that it had exchanged contracts, Ardonagh Advisory has completed its acquisition of Westfield Brokers Ltd.