Financial results show combined strength of newly formed Group

Significant uplift in profitability and sales underpinned by strong Organic1 growth

Accelerated execution of transformation plan

The Ardonagh Group (“Ardonagh” or the “Group”), the UK’s leading diversified independent insurance intermediary, today announces its first set of financial results for the six months ended 30 June 2017.

The Group, created in June 2017, brings together Autonet, Chase Templeton, Direct Group, Price Forbes and Towergate and is comprised of a network of more than 100 office locations globally and a workforce of over 5,500 people.

John Tiner, Chairman of The Ardonagh Group, commented: “This is a strong set of results, particularly in the context of the substantial activity undertaken by the team to launch the Group earlier this year, including the successful completion of a refinancing to optimise our capital structure.

“We have delivered a solid operating performance with good underlying organic growth and significant improvement in Adjusted EBITDA2, while accelerating our investment plan and aligning resources with our new segmental operating model incorporating Distribution, Wholesale and MGA & Services4.”

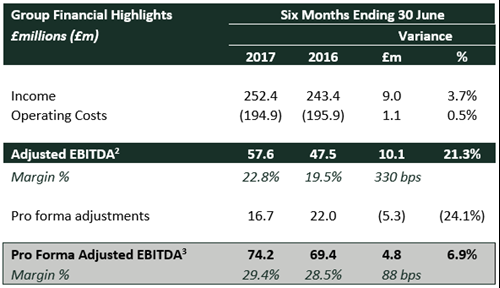

GROUP FINANCIAL HIGHLIGHTS

GROUP OPERATIONAL HIGHLIGHTS

- Successful c.£800 million bond issuance to global, blue chip investors completed in June 2017

- Additional equity investment of over £20 million from minority investors endorses Group strategy

- Strong operational performance, with income growth of +3.7% and Adjusted EBITDA2 up +21.3%

- Transformation plan ahead of schedule with £40 million annualised savings delivered and £19 million completed in the period

- Pro forma net secured leverage decreased from 5.67x to 5.48x as a result of improvement in LTM Pro Forma Adjusted EBITDA3 and higher pro forma operating cash of £57 million versus £42 million

- Leaders appointed for new segmental operating structure

- Continued investment in top quality income generators to drive pipeline of further organic growth

- Robust pipeline of M&A opportunities with six highly accretive acquisitions completed in Distribution since December 2016 and acquisition of Healthy Pets completed in September 2017

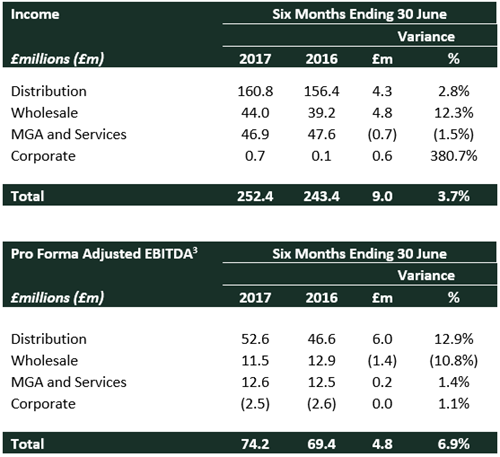

SEGMENTAL FINANCIAL HIGHLIGHTS

SEGMENTAL OPERATIONAL HIGHLIGHTS

Distribution

- Good Organic1 growth of +2.1% resulting from improved retention and positive new business developments

- Significant improvements in EBITDA margin driven by business transformation and continued cost focus

- Accelerated investment in our Broker System Consolidation project expected to deliver benefits ahead of plan

Wholesale

- Strong Organic1 growth of +12.3% driven by favourable foreign exchange movements and impact of new producers

- Positive steps taken to increase presence in London Wholesale Market with priority on revenue driving initiatives

- Strong pipeline of future hires supports the Group’s ambition to deliver consistent growth above market

MGA & Services

- Margin improvement through targeted cost control, focus shifting to growth and remedial action of certain portfolios

- Strong pipeline of new business in Services and accelerated delivery of intra-group synergy opportunities

- Significant progress on key income initiatives including International MGA and London Markets

- Investment continues in system upgrades, sales and technical capabilities in Household and Agricultural lines

David Ross, Chief Executive of The Ardonagh Group, commented:

“It gives me great pleasure today to be sharing this first set of financial results for The Ardonagh Group.

The past six months have seen the successful refinancing of our capital structure, the acquisition of Chase Templeton and Direct Group and the launch of our new brand, resulting in the creation of the UK’s leading independent insurance services provider.

The progress we report today is testament to both the strength of the individual brands in the Group and its combined power in a market which continues to present us with significant opportunities.

We have grouped our businesses into operating segments: Distribution, Wholesale, MGA & Services4. In August, we announced that Gordon Newman will lead our Wholesale segment, comprising our Bishopsgate and Price Forbes businesses; two distinct and leading specialty brands which continue to attract the very best talent in the market. Janice Deakin will lead our Distribution segment, with oversight of our broking brands including Towergate and Autonet. Paul Dilley will lead our MGA segment and Adrian Brown will lead on Services.

Our clear strategy, validated by global investor support during our refinancing in June, focuses on top-line growth, both organic and through carefully targeted M&A activity. Harnessing the Group’s combined buying power continues to present opportunities in both income and EBITDA and we expect significant benefits from cross-selling and up-selling across the Group companies.

The numbers we are reporting today reflect a solid business with strong underlying growth, performing ahead of expectations and against a backdrop of significant change. We head into the second half of 2017 with strong trading momentum and ample liquidity to support continued targeted investments in income and cost initiatives.

I would like to take this opportunity to thank our people for their continued and unwavering commitment to a Group they feel truly proud of; a genuinely best in class company.”

Notes to Editors

1 We define “Organic” as excluding the impact of acquired or exited businesses and other non-recurring items and is set out at actual FX.

2 We define “Adjusted EBITDA” as the profit or (loss) on ordinary activities before finance costs, income tax, depreciation and amortisation charges, share of loss from an associate and impairment of goodwill, adjusted for loss or (profit) on the disposal of businesses, related party bad debt provision, reduction in value on contingent consideration, group reorganisation costs, regulatory costs, asset write-downs in connection with business restructuring, business investment costs, consultancy on regulatory matters, levy costs and finance legacy review costs, as applicable. Adjusted EBITDA is stated before exceptional costs and one-off items as determined by management. This includes Towergate, Price Forbes, Autonet, Direct Group and Chase Templeton financial results as if owned for the full period shown in the current and prior financial year.

3 We define “Pro Forma Adjusted EBITDA” as the Adjusted EBITDA of each of Towergate, Price Forbes, Autonet, Direct Group and Chase Templeton, each as adjusted for overhead costs currently incurred by The Ardonagh Group, Atlanta Holdco and PF Holdco, certain cost saving initiatives and cost synergies, a USD/GBP FX adjustment related to Price Forbes and certain other transactions adjustments including certain UK GAAP to IFRS adjustments.

4 For the purposes of financial reporting, MGA and Services will be combined into one segment.

About The Ardonagh Group

The Ardonagh Group is the UK’s largest independent insurance broker with global reach. We are a network of over 100 office locations and a workforce of over 5,500 people.

The Ardonagh Group was created in June 2017, bringing together Autonet, Chase Templeton, Direct Group, Price Forbes and Towergate, with the additional acquisition of Healthy Pets in August 2017.

Our understanding of the communities we serve, together with our scale and breadth, allows us to work with our insurer partners to deliver solutions that meet our customer needs.

Disclaimer

This document has been prepared by The Ardonagh Group Limited (‘Ardonagh’) and is its sole responsibility. For the purposes hereof, this document shall mean and include this document, any oral presentation by Ardonagh or any person on its behalf, any question-and-answer session in relation to this document, and any materials distributed at, or in connection with, any of the above.

The information contained in this document has not been independently verified. No representation or warranty, express or implied, is or will be made by any person as to, and no reliance should be placed on, the accuracy, fairness or completeness of the information or opinions expressed in this document. No responsibility or liability whatsoever is or will be accepted by Ardonagh, its shareholders, subsidiaries or affiliates or by any of their respective officers, directors, employees or agents for any loss howsoever arising, directly or indirectly, from any use of this document or its contents or attendance at any presentation or question-and-answer session in relation or in connection with this document.

Ardonagh cautions that this document may contain forward looking statements in relation to certain of Ardonagh’s business, plans and current goals and expectations, including, but not limited to, its future financial condition, performance and results. These forward looking statements can be identified by the use of forward looking terminology, including the words “aims”, “believes”, “estimates”, “anticipates”, “expects”, “intends”, “may”, “will”, “plans”, “predicts”, “assumes”, “shall”, “continue” or “should” or, in each case, their negative or other variations or comparable terminology or by discussions of strategies, plans, objectives, targets, goals, future events or intentions. By their very nature, all forward looking statements involve risk and uncertainty because they relate to future events and circumstances which are beyond Ardonagh’s control, including but not limited to insurance pricing, interest and exchange rates, inflation, competition and market structure, acquisitions and disposals, and regulation, tax and other legislative changes in those jurisdictions in which Ardonagh, its subsidiaries and affiliates operate. As a result, Ardonagh’s actual future financial condition, performance and results of operations may differ materially from the plans, goals and expectations set out in any forward-looking statement made by Ardonagh. All subsequent written or oral forward looking statements attributable to Ardonagh or to persons acting on its behalf should be interpreted as being qualified by the cautionary statements included herein. As a result, undue reliance on these forward-looking statements should not be placed.

The information and opinions contained in this document have not been audited or necessarily prepared in accordance with international financial reporting standards and are subject to change without notice.

The information contained in this document, including but not limited to any forward-looking statements, is provided as of the date hereof and is not intended to give any assurance as to future results. No person is under the obligation to update, complete, revise or keep current the information contained in this document, whether as a result of new information, future events or results or otherwise. The information contained in this document may be subject to change without notice and will not be relied on for any purpose.

Media Queries Internal & External Contact

-

Email: communications@ardonagh.com

Media Queries External Contact

-

Email: communications@ardonagh.com

Investor Relations Contact

Karen Noakes - Corporate Finance and Investor Relations Director

Email: karen.noakes@ardonagh.com

Latest announcements

Ardonagh Advisory builds presence in northwest England with acquisition of SIB Insurance

Ardonagh Advisory has acquired Southport Insurance Brokers Limited (SIB Insurance), an independent commercial broker, further strengthening Ardonagh’s presence in the northwest of England.

Ardonagh Advisory completes acquisition of Westfield Insurance

Further to its announcement in December that it had exchanged contracts, Ardonagh Advisory has completed its acquisition of Westfield Brokers Ltd.