22 May 2018

A strong operating performance with Adjusted EBITDA up 12.7% year on year

Continued investment in growth through strategic acquisitions, key hires and front-end systems

The Ardonagh Group (“Ardonagh” or the “Group”), the UK’s leading diversified independent insurance intermediary, today announces its financial results for the three months ended 31 March 2018.

The Group comprises six segments – Autonet and Carole Nash, Paymentshield, Insurance Broking, Schemes and Programmes, MGA and Wholesale – which together operate more than 20 leading consumer brands and employ 6,000 people across over 100 locations.

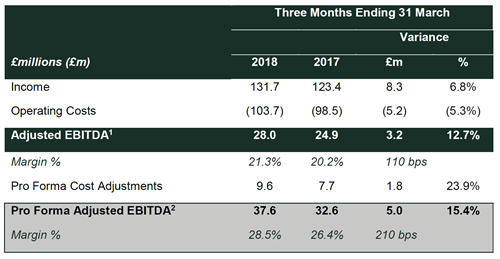

Income grew by 6.8% to £131.7million and Adjusted EBITDA climbed 12.7% to £28.0 million in the first quarter.

CEO David Ross said: “We have had a strong start to the year with underlying organic growth supported by strategic investments. With three small acquisitions completed in the quarter and several key hires, we continue to invest in businesses and people that want to become part of a disruptive and dynamic force in the market.”

GROUP FINANCIAL HIGHLIGHTS

GROUP OPERATIONAL HIGHLIGHTS

- Strong performance with organic growth3 across all business units except MGA, where income was adversely impacted by accelerated implementation of remedial actions aimed at refocusing the business on higher growth specialty niches and reducing exposure to underperforming standard books

- Continued investment for growth with £5.2 million spent on key hires and 41 income producers offered jobs or hired within Broking in the first quarter

- Towergate Transformation Plan now 85% complete, with Broker Systems Consolidation anticipated to complete 12 months ahead of plan

- Strong cost control and realisation of opportunities and operational efficiencies across the Group

- Net Secured Leverage broadly unchanged at 5.4x

- We define “Adjusted EBITDA” or “ EBITDA” as the profit or (loss) on ordinary activities before finance costs, income tax, depreciation and amortisation charges, share of loss from an associate and impairment of goodwill, adjusted for loss or (profit) on the disposal of businesses, related party bad debt provision, reduction in value on contingent consideration, group reorganisation costs, regulatory costs, asset write-downs in connection with business restructuring, business investment costs, consultancy on regulatory matters, levy costs and finance legacy review costs, as applicable. Adjusted EBITDA is stated before exceptional costs and one-off items as determined by management. This includes Towergate, Price Forbes, Autonet, Direct Group and Chase Templeton financial results as if owned for the full period shown in the current and prior financial year.

- We define “Pro Forma Adjusted EBITDA” or “Pro Forma Adj. EBITDA” as the Adjusted EBITDA of each of Towergate, Price Forbes, Autonet, Direct Group and Chase Templeton, each as adjusted for overhead costs currently incurred by The Ardonagh Group, Atlanta Holdco and PF Holdco, certain cost saving initiatives and cost synergies, a USD/GBP FX adjustment related to Price Forbes and certain other transactions adjustments including certain UK GAAP to IFRS adjustments.

- We define “Organic” as excluding the impact of acquired or exited businesses and other non-recurring items and is set out at actual FX.

Notes to Editors

ABOUT THE ARDONAGH GROUP

The Ardonagh Group is the UK’s largest independent insurance broker with global reach. We are a network of over 100 office locations and a workforce of 6,000 people. The Ardonagh Group was created in June 2017, bringing together Autonet, Chase Templeton, Direct Group, Price Forbes and Towergate, with the additional acquisitions of Healthy Pets in August 2017, and Carole Nash and Mastercover announced in December 2017.

Our understanding of the communities we serve, together with our scale and breadth, allows us to work with our insurer partners to deliver solutions that meet our customer needs.

Latest announcements

Ardonagh Advisory builds presence in northwest England with acquisition of SIB Insurance

Ardonagh Advisory has acquired Southport Insurance Brokers Limited (SIB Insurance), an independent commercial broker, further strengthening Ardonagh’s presence in the northwest of England.

Ardonagh Advisory completes acquisition of Westfield Insurance

Further to its announcement in December that it had exchanged contracts, Ardonagh Advisory has completed its acquisition of Westfield Brokers Ltd.